Selling Gold and its Benefits: Why Now is a Great Time to Cash in on Your Assets

The Real Benefits of Selling Gold

Whenever you hear people talking about buying gold, they usually talk about how it’s a good investment in a time where the economy is under tension. They want to buy gold as a way to insulate their finances from future inflation or financial crises. However, selling gold is a different story, and it’s likely a healthier approach for most people. You might have a box of old jewelry with mountains of tarnished pieces, or you might have some gold bars, Swiss government-issued coins known as ‘20 Francs’ or any other form of bullion. Selling gold can help you unlock a more comfortable financial future.

Immediate Access to Cash

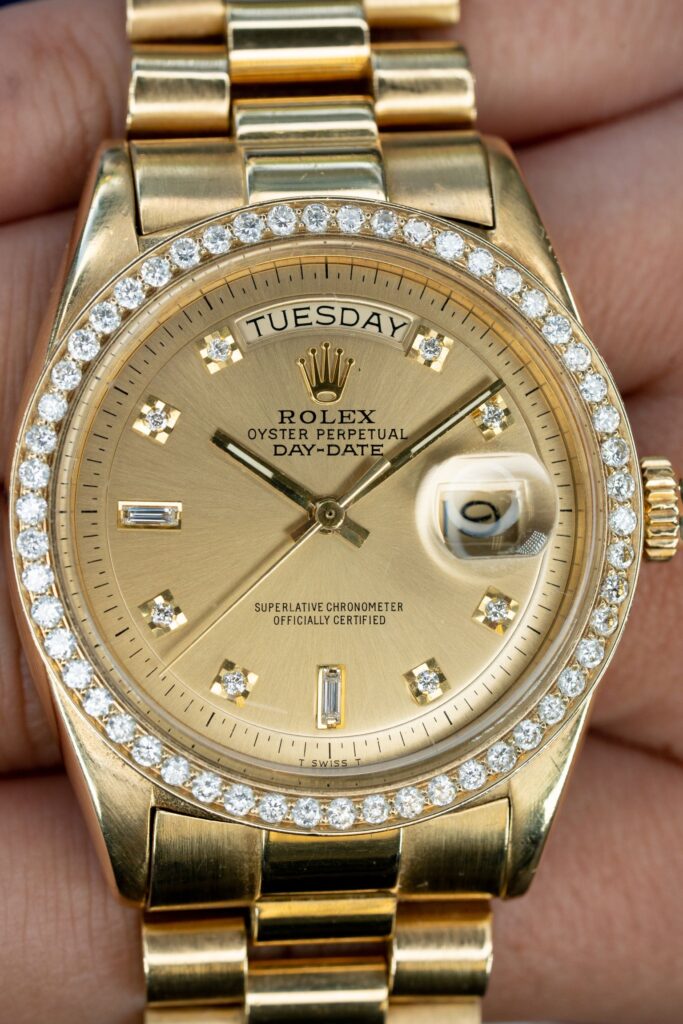

One of the most immediate benefits of gold sales is the opportunity to have cash on hand. Gold is a very fluid asset to sell and, with the high liquidity of bullion gold, there are always buyers. One of the best options is to sell to a jewelry store. Diamonds by Raymond Lee in Boca Raton is always willing to buy gold. They will readily pay near-spot prices, even for fairly small amounts of gold. The money in return can be an invaluable resource for emergencies, so that you don’t have to borrow money that’s going to cost you huge interest payments. Suppose you need to come up with cash for medical expenses, or perhaps you have home repair needs, business capital calls or other urgent needs that must be met immediately? You can deal with these emergencies with funds from gold sales, and turn a normally illiquid asset that isn’t readily accepted as payment, into a readily usable working capital resource.

Taking Advantage of High Market Prices

Gold prices have been known to go up when there is a period of economic uncertainty such as in a recession or when there is an increase in inflation. The price of gold has continued to appreciate over the last several years. When the price is high, it can be a perfect time to sell because when there is a high demand, prices often go up. If you purchased gold many years ago, or inherited precious gems, now may be an excellent time to take advantage of the price appreciation and sell your items to profit on your investment.

Hedge Against Declining Assets

We might see fluctuations in the values of different assets in a well-diversified portfolio, especially if there’s a downturn in the economy and in investments such as equities or real estate. When other investments aren’t performing well – and particularly when they’ve declined in value – an investment (or an asset) such as gold can constitute an excellent hedge against your contravening assets. So, being well-diversified ensures that not all of your wealth is dependent on particular investment, mitigating a risk leading to an unsatisfactory intrinsic relation. If you have quite a few gold-dependent assets in your portfolio, and like other people, saw its value rise during the most recent downturn, then rebalancing your portfolio might stand to gain from selling your gold.

Simplifying Your Financial Portfolio

With the passing years, perhaps you’ve accumulated silverware, gold jewelry, old coins or gold bars but failed to create a strategy for how to manage all of it as part of your overall financial picture. If owning gold is truly a part of this strategy, then you want to know exactly what you can afford and what percentage of your overall finances are tied up. You may be asking yourself the same questions I ask myself: ‘What do I have, and why do I have it?’ When you sell your gold, you might find that your finances feel simpler to manage. You can easily keep track of the gold and its price to decide what might be the best future move for you – buying more, holding tightly, or cashing out. It helps if your whole financial picture is streamlined and under control, so that you can focus on your own bigger goals and life projects.

Opportunity to Reinvest in Other Ventures

Selling gold allows you to diversify your investments or back new financial initiatives. A chunk of that money can be reinvested into other assets, in the form of stocks and bonds, that could potentially deliver greater returns. Or you could use the money for a start-up, pay off your high-interest debts or build your nest egg for retirement. Over time, returns on assets that are diversified and growth-oriented could be better than what you would make storing physical gold.

Selling Gold Helps Capitalizing on Tax Benefits

Selling gold can also have some tax benefits, especially in areas where tax rates are lower on the gains from selling appreciated assets. Learn the specific tax implications of selling, as capital gains tax rates and exemptions vary from country to region. In some cases, long-term capital gains rates may apply that could be lower than regular income tax rates. Before you sell your gold, it may benefit you to contact a financial planner or tax advisor to maximize your return and save on taxes.

Avoiding Market Volatility When Selling Gold

While gold is seen as a relatively stable asset compared with other investments, the precious metals markets are not immune from volatility. There are many factors that affect prices, such as world economic conditions, geopolitical tensions and changes in the value of currencies. In case you’re still holding onto those gold handed down by your grandmother, remember that perhaps you weren’t lucky – it’ll be harder to time the market correctly for gold price increases versus selling in a period of elevated prices. Gold, after all, can be an asset that declines in value if world market conditions reverse.

Supporting Sustainable and Ethical Practices

In turn, selling unwanted gold is a sustainable and ethical buying decision. The extraction of new gold from the ground is ecologically damaging and often labor-intensive, often with work conditions that cause community and life-cycle impacts that are unethical. By selling off what you already have, you are circulating existing gold and reducing demand for new gold. Depending on who you sell to and buy from, that will be a positive environmental and ethical act.

Enjoying Peace of Mind and Financial Flexibility

In addition, selling gold can bring peace of mind. The additional financial flexibility can eliminate financial stress and help you lead a better quality of life. The money from selling your gold can provide a financial security net to allow you to focus on your goals and manage the unknowns that may come up without as much anxiety. Financial flexibility can be one of the most important pillars of a solid financial future, and selling gold can help ensure a more stable and flexible financial future.

Selling Gold as a Smart Financial Move

Gold is worth holding, but no one should hold it forever. Sell your gold and cash in many benefits immediately, including use of cash, reduction of storage and security costs, and the chance to reinvest your proceeds in something more profitable. There are even times, like when the spot price is high, when it makes sense to sell gold for a huge profit. You only have access to the value of your gold holdings if they’re converted, and the more money you have to work with, the fewer constraints you have on what you can do. Gold is certainly of value, but the advantages to selling can exceed the value of gold itself, making it worthwhile for anyone. Make sure to visit Diamonds by Raymond Lee, which is a wonderful store that you can trust to always sell your gold to for a fair price. You may even find some other stuff you enjoy along the way!