How Can I Buy Investment Diamonds in Boca Raton?

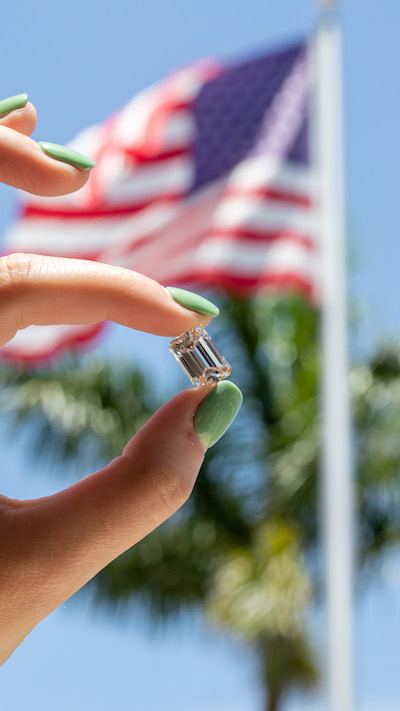

If you live in Boca Raton and you are looking to expand your portfolio during this unprecedented buyer’s market, investing in diamonds may be the most promising alternative investments you can make. At Diamonds By Raymond Lee in Boca Raton, we are not only experts in investment diamonds, but we also sell loose diamonds and designer jewelry at a price that beckons investors from all around the area.

It might be a surprise to some of you to learn that diamonds have enjoyed a boom in sales during the COVID-19 lockdown, both because wealthy investors are seeking a sparkling new precious stone to lift their spirits and even more so because its an unprecedented buyer’s market right now.

Although COVID has caused a spike in diamond investments, diamond investing has been a trend long before these dreary times. This is because over the last couple of decades, diamond prices have been steadily trending up.

From 1999 to 2011, three-carat diamond prices saw an increase of 145 percent, while five-carat diamond prices grew by 171 percent.

Of course, with the current pandemic, diamond prices have dropped significantly as retail jewelry sales are down. However, experts in the industry, like Diamonds By Raymond Lee in Boca Raton, are thoroughly decided that prices will return back to normal and then continue uptrending as it was. Why? Because rare, large, exquisite diamonds are becoming increasingly harder to find. Moreover, the supply has dropped significantly due to travel restrictions this year. Once the economy gets back on track, the obvious outcome is a seller’s market. This is enviable, even if it takes years to come to fruition. The point is, you can buy low now and sell high when that time comes.

Below we will go over some of the most important things you should know about investing in diamonds and where you can buy investment diamonds in Boca Raton.

DECREASE IN DIAMOND JEWELRY RETAIL SALES VS INCREASE IN DIAMOND INVESTMENTS

In terms of overall retail sales, things haven’t been so “sparkling” for jewelers and jewelry stores. Retail sales are down.

This drop in retail jewelry sales has caused diamond prices to dip. Thus creating a buyer’s market for investors who are not afraid of alternative investments like diamonds & gemstones.

It’s undoubtedly the perfect time to invest in diamonds. Buying large high-quality natural diamonds with the plan to hold onto them for a few years until the market returns to normal is a wise investment. Of course, there are risks, but that’s only if you think the jewelry market is on its way out. The chances of that are slim to none.

People will always want to celebrate love, relationship milestones, and other special moments with luxury items like diamond jewelry. Diamond jewelry has positive psychological benefits on people. It’s been this way for centuries. It is deeply ingrained in our nature. Ancient humans even thought gemstones had magical powers.

Couple that with the fact that investment-worthy gemstones are increasingly scarce and you are left with an unadulterated commodity with everlasting intrinsic value.

And when we say everlasting, we mean it. Think about investments in energy investments like oil, how long will oil truly be a commodity? It may be a hundred years but will it be forever? Of course, not. However, gemstone and precious metal trade have been around for thousands of years. It’s not going anywhere.

With all that, for those who have the wherewithal and are willing to do their research, it’s worth at least looking into loose diamond investments and designer jewelry investments.

Comparing to other alternative investments, like wine and art, investment-grade diamonds are looking very brilliant these days.

EXPERT ADVICE IS A MUST FOR INVESTING IN DIAMONDS

Like any investment, it’s not for the faint-hearted. There are risks involved when investing in diamonds. Just like any investment. However, if you know what you are doing, you can minimize risks and make great investments.

To be a diamond investor, you need to have the knowledge. Thankfully, that doesn’t mean you must know everything, you just need to know someone who does.

Having a trustworthy gemologist as your advisor when investing in diamonds is a must. They will guide you through smart diamond investments. Every stone you buy should be confirmed by a gemologist if you want a truly rock-solid investment, pun intended.

At Diamonds By Raymond Lee in Boca Raton, we are the most trustworthy diamond advisors in all of Boca Raton. Our team is made up of seasoned gemologist who will help you select the best investment diamonds. Our goal is to get you the best value for your money, every single time.

DIAMOND PRICES ARE HEAVILY SKEWED

When beginning your diamond investment journey, you will be delving into an unregulated market with tons of nuances. There are no set prices for diamonds like there is with gold. They are not homogenous. In other words, no two diamonds are the same.

The value of a diamond is based on the 4Cs, as well as supply & demand. As we’ve already discussed supply & demand (hence, our point that it is a buyer’s market), let’s look at the 4Cs of diamonds.

4CS OF DIAMONDS

The 4Cs of diamonds are cut, color, clarity and carat weight. Within each of these “categories”, there are a lot of distinctions, which gemological laboratories group into grades.

Cut [light performance]: Cut grades range from Excellent to Poor

Color [whiteness]: Color grades range from D-Z (D being the best, which is colorless)

Clarity [purity]: Clarity grades range from F (flawlessness) to IS3 (Included) – Flawless means the diamond has no inclusions even under 10x magnification, while IS3 will have inclusions that a visible to the naked eye.

Carat weight [size]: Carat weight is measured in grams. 1 carat is 0.2 grams.

All of the above will determine the value of the diamond.

As there are so many grades between the ranges we mentioned above, pricing becomes quite complicated for the inexperienced. What’s more, even the price will have a range, because it all depends on what someone will pay. Again, it’s not like gold where there is a set market price that everyone follows.

Note: For carat weight, price doesn’t increase in a direct manner. The price for two 1-carat diamonds will be significantly less than one 2-carat diamond because the larger the diamond, the rarer it is. Large diamonds are more scarce, so the value reflects that.

Now, we don’t mean to complicate things too much for you, we just want you to understand the importance of working with an expert gemologist when coming to a value for any given diamond. That way you know if the price you are buying it for is worth it or not as an investment.

THE 5TH C – DIAMOND CERTIFICATE

If you are buying a diamond, not just as an investment but in general, make sure it has a diamond certificate. The certificate will state the quality of a diamond, which includes the gradings of the 4Cs and more.

Even if a gemologist ensures you of the 4Cs, you still want a diamond certificate for your diamond. This is diamond buying 101.

A diamond certificate is essential not only for peace of mind but also if you plan to resell the diamond. No one will buy a diamond without a certificate. So, neither should you.

A diamond certificate is done by an independent laboratory grading organization. The Gemological Institute of America (GIA) is the best diamond certification lab. In our opinion, it is the only one you want. When a diamond has a GIA certification, you can be sure it is one hundred percent correct. GIA has the strictest criteria of all gemological laboratories.

COLORED DIAMONDS

Colored diamonds have been catching the eye of investors for the past decade. They have become highly valuable due to their rarity.

To give you an idea of a color diamond’s rarity, for every ton of rock mined, there may be one carat of white diamond, while the production rate for a colored diamond would be 0.1 percent of that.

Note: Colored diamonds color grade ranges from vivid to light fancy. Beyond the lowest grade (light fancy), the diamond is just a white diamond with a poor color grade. That said, it is typically very easy to spot the difference between a fancy colored diamond and a poor color grade white diamond.

As for the rarest diamond colors, they are red and blue diamonds. However, pink and yellow are the most sought after. And sometimes, the best investment are the ones people want, not the rarest.

Let’s dig (or better yet, mine) this point a little deeper.

“JUST BECAUSE A DIAMOND IS OF THE HIGHEST GRADE DOESN’T MEAN ITS THE MOST INVESTABLE”

Needless to say, the world’s most expensive diamonds at auctions are the rarest, most exquisite quality diamonds. However, these are very, VERY few and far between. Moreover, the prices are exorbitant even by the richest of people’s standards.

If you are looking for sound diamond investment, you don’t need to get the highest quality and largest diamond you can afford. You know why? Because oftentimes, those will be the hardest to sell, as they have less demand. Moreover, you will have to pay a premium for them in the first place.

So, we often recommend going for a high grade diamond that is sizable, but not the highest grades of the 4Cs. For example, you would get the best bang for your buck and have the easiest resale with a 3-5 carat diamond that is of Good or Very Good Cut, H-I color, and VVS or even SI clarity.

To give you an example, someone is much more likely to buy a good quality 2 carat diamond for $15,000 than a flawless 2 carat diamond for $50,000.

There are caveats to this point we are making, but we just want you to understand that the highest quality diamond possible is not always the best investment for every kind of investor. This makes our point of finding an expert that you can work with even more important. They will lead you through these points based on your own investment preferences.

MINIMUM DIAMOND INVESTMENT

When investing in diamonds, a modest investment will be at least $5,000.

To give you some reference, a one carat diamond, which is 200 milligrams and just about six millimeters in diameter, can range from $1,500 to $15,000 depending on the cut, clarity, color, and shape, with cut typically being the most important aspect and the biggest determining factor for value.

Diamond price range by carat size:

1 carat diamonds: $1,500-$15,000

2 carat diamonds: $8,000-$50,000

3 carat diamond $15,000-$100,000

5 carat diamond: $20,000-$150,000

10 carat diamond: $160,000-$2.25 million

BEST DIAMONDS TO INVEST IN

Diamonds that are the most liquid: High-grade diamonds ranging from 0.5 carats to 2 carats are great for investments as they are the most liquid. You will not have trouble reselling diamonds of these sizes if they have a GIA certificate. However, they will likely not appreciate in value in any significant way in just a few years.

Diamonds that will always appreciate in value: Diamonds over 3 to 7 carats have proven to appreciate in value with time. These carat sizes make up the majority of diamond investments for the average investor. This is because they are easy to price. While they are rare, there is still enough information out there to get a general price.

Cream of the crop for investment-grade diamonds: High quality diamonds over 8 carats are the cream of the crop for investments. These have the best potential to significantly appreciate in value over time. That said, they will also be the hardest to sell as you need to find an affluential buyer who is willing to pay you what it’s worth. If you are dealing with a flawless clarity, D-F color, excellent cut 10+ carat diamond then you will likely need to take this to an auction. This is even more true for large fancy colored diamonds of supreme quality, as they are the rarest.

Best diamonds for initial investments

If you want to get your feet wet in diamond investing, the best initial investments will be a round brilliant, 1.01-1.49 carat, D-H color, IF-VS2, Excellent-Very Good Cut diamond. Get a few of these and you can expect to turn a profit.

Note: With it being a buyer’s market right now, you will very likely be able to negotiate a better price than the diamond carat price ranges we mentioned above. This is why diamond investments are booming for those who have the means to take action.

All in all, certain types of diamonds, including fancy colored diamonds, hold their value very well. This is a fact when looking at the last couple decades. Comparing to other more volatile equity investments like oil, gas, coal, and renewable energy technologies, diamonds look just as good, if not better. The same applies to investments in things like wine and art.

So, if you are open to that, you should definitely be open to investing in diamonds. Plus, unlike wine investments which you must keep bottled up, diamonds are an investment you can enjoy, even more so than art. Why? Because you can wear them!

AN INVESTMENT YOU CAN WEAR – EMOTIONAL & FINANCIAL INVESTMENT

Set a loose diamond or precious gemstone in a piece of jewelry and you can enjoy this investment by wearing it! What other investment can you say that about? Emotional investment and financial investment all in one.

Speaking of diamond investments that you can wear, designer jewelry pieces have seen tremendous growth over the past decade and during this COVID lockdown. We are talking about value rising by over 80 percent over the last decade. Items at auction are selling for much higher prices than auctioneers are estimating.

DESIGNER BRANDS – 80% INCREASE OVER THE PAST DECADE

The best designer pieces come from brands like Cartier, Cleef & Arpels, Belperron, Boucheron, Bulgari, Chaumet, Lalique and Tiffany.

Look for pieces with the designer’s signature.

Since the COVID lockdown, some vintage pieces from these kinds of historical brands have been significantly exceeding the estimated auction prices. Much of the buying is taking place by new collectors. This tells us people are hungry to get their feet wet in diamond and designer jewelry investments.

Note: Diamond and jewelry investors may need to factor in security costs. Any diamond or jewelry with a value of more than $5,000 should be listed on your home insurance.

NO CAPITAL GAINS TAX

For us Americans, and unlike how it is in the UK and EU, if you buy a diamond as an investment then sell it afterward, you are not subject to capital gains tax. This is a major benefit of investing in diamonds that most investments don’t share.

INVESTING IN DIAMONDS WITH DIAMONDS BY RAYMOND LEE IN BOCA RATON

Right now Diamonds By Raymond Lee in Boca Raton is excepting all reasonable offers. We have a wide range of loose investment-grade diamonds and collectible jewelry from designer brands. We are willing to sell low because in times like this we are looking to stay afloat and keep our local economy strong.

How can we sell for a price that makes sense for investors when we are a jewelry store?

At Diamonds By Raymond Lee in Boca Raton, we have no middleman, we buy and sell directly to our community. What’s more, we have built up a very large inventory in our nearly 4 decades of being in the industry.

If you have any questions about investing in diamonds, you can speak to one of our expert gemologists. We are here 7 days a week to help you make a smart investment in diamonds.